In the digital era, the Unified Payments Interface (UPI) has emerged as a game-changer in online payments. This secure and user-friendly system allows individuals to transfer funds instantly between bank accounts, making transactions seamless and hassle-free. In this blog, we will delve into the world of UPI, exploring its complete form, functionality, safety measures, and the ease of money transfer it offers.

UPI and net banking are convenient and secure digital banking services that empower customers to perform various financial transactions, such as fund transfers, bill payments, and online shopping, from the comfort of their homes or on the go. To know more about net banking, read our blog on How to apply IPO online with ASBA through SBI Bank NetBanking?

What is UPI?

UPI is a real-time payment system developed by the National Payments Corporation of India (NPCI). UPI is a common platform that enables various banks to link together, allowing users to make instant money transfers using their smartphones.

UPI Full Form: Decoding UPI’s Name

The complete form of UPI is Unified Payments Interface. This name reflects the purpose and functionality of the system. UPI aims to unify different banking systems and interfaces under a single platform, simplifying digital payments for users across India.

How UPI Works?

UPI operates on a mobile application that connects with your bank account. You must download a UPI-enabled app from your respective bank or a third-party app provider to use UPI. After installing the app, you can link your bank account to it by providing the necessary details.

Once your account is linked, you can create a unique Virtual Payment Address (VPA) associated with your bank account. This VPA is a substitute for your bank account details during transactions, making it more secure. UPI lets users directly link their mobile number and bank account, making transactions even more convenient.

You must enter the recipient’s VPA or mobile number when initiating a transaction. The Unified Payments Interface system verifies the details and prompts you to enter the transaction amount. After you confirm the amount, it prompts you to enter your UPI Personal Identification Number (PIN) to authorize the transaction. Once you validate it, the UPI system instantly transfers the funds from your account to the recipient’s account.

What is UPI PIN?

UPI PIN refers to the Personal Identification Number associated with your Unified Payments Interface account.

This four to six-digit UPI PIN is a security measure to prevent unauthorized access to your transactions.

It is essential to keep your UPI PIN confidential and never share it with anyone. This ensures that only you can authorize transactions from your UPI account, adding an extra layer of security.

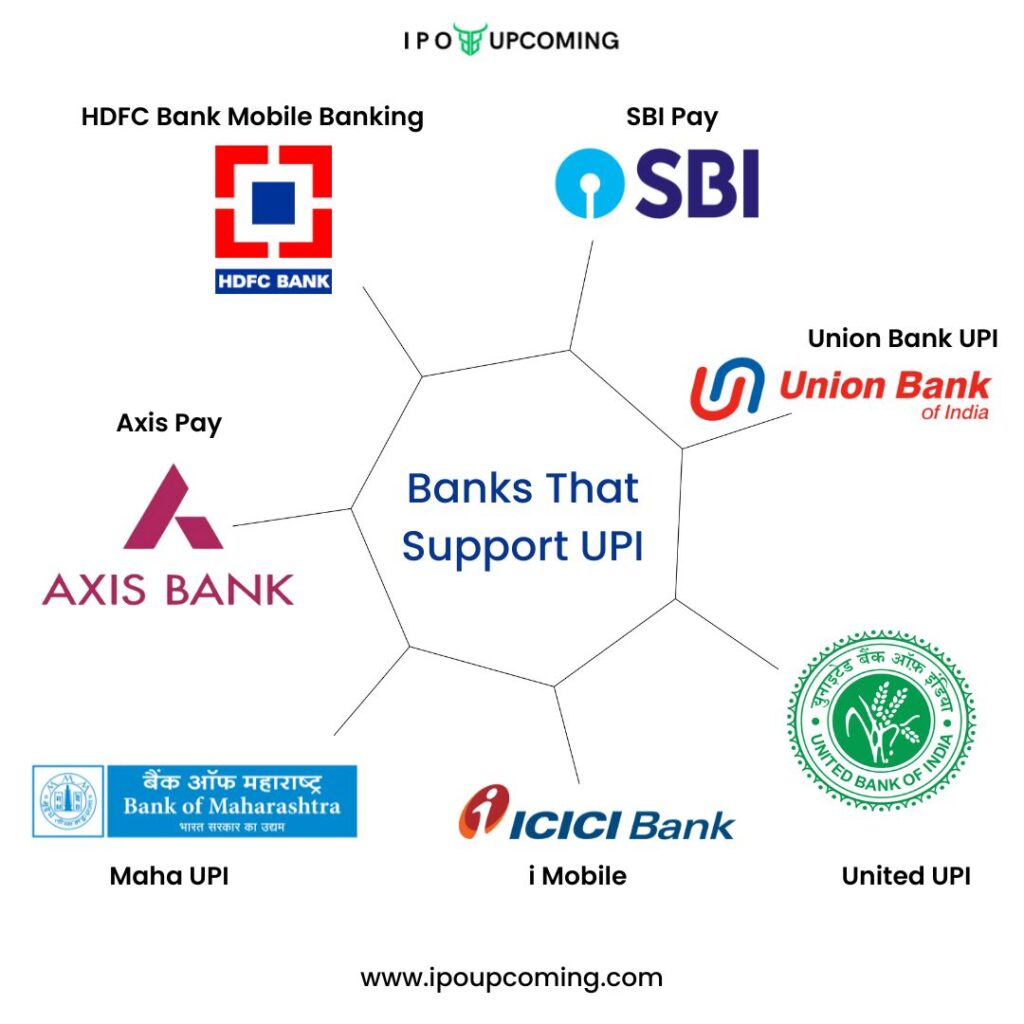

Banks That Support Unified Payments Interface Services

Many banks support Unified Payments Interface services, allowing customers to easily make instant transactions and transfers using their mobile devices.

Who Came Up with UPI: The Creators Behind the Innovation

Unified Payments Interface was conceptualized and developed by the National Payments Corporation of India (NPCI). NPCI is an umbrella organization that aims to revolutionize digital payments and create a robust and efficient banking ecosystem in India. With UPI, NPCI has transformed how Indians transact, simplifying payments for millions of users.

Is UPI Safe: Ensuring Secure Transactions

UPI follows strict security protocols to ensure the safety of transactions. It uses multi-factor authentication, including the UPI PIN, to authorize transactions.

Additionally, Unified Payments Interface employs encryption and secure socket layers (SSL) to protect user data and prevent unauthorized access. However, it is crucial to remain cautious while using UPI, ensuring you only download apps from trusted sources and keep your UPI PIN confidential.

Transfer Money Through Unified Payments Interface: Convenience at Your Fingertips

One of the critical benefits of UPI is its convenience. Using UPI, you can transfer money instantly to anyone, anytime, without the need for bank account details.

UPI is not limited to fund transfers; it also enables bill payments, merchant transactions, and even mobile recharges, making it an all-in-one solution for digital payments.

Here are the steps to transfer money through UPI:

- Download a UPI-enabled app from your bank or a trusted third-party provider. The most common are PhonePe, Paytm and BHIM app

- Install and open the app on your smartphone.

- Complete the registration process by providing your mobile number, bank account details and creating a UPI PIN.

- Link your bank account to the UPI app by following the provided instructions.

- Set up a Virtual Payment Address (VPA) associated with your bank account, which will serve as your unique identifier during transactions.

- Ensure that the recipient also has a UPI-enabled app and a VPA.

- Open the UPI app and select the option to send money or make a payment.

- Enter the recipient’s VPA or scan their UPI QR code using the app’s “Scan and Pay” feature.

- Enter the amount you wish to transfer and add an optional description.

- Verify the details and confirm the transaction.

- Enter your UPI PIN to authorize the transfer.

- Once you validate it, your bank account will instantly transfer the money to the recipients.

- You will receive a confirmation message or notification regarding the successful transaction.

- Check your transaction history in the UPI app for reference and record-keeping.

Remember to ensure the accuracy of the recipient’s VPA or QR code and review the transaction details before confirming the transfer to avoid any errors.

UPI: The Revolutionary Payment System

The Unified Payments Interface (UPI) has revolutionized how Indians transact digitally. UPI has become an integral part of the digital payment ecosystem with its secure, user-friendly, and convenient features.

Whether transferring money, paying bills, or making purchases, UPI provides a seamless and efficient platform for hassle-free transactions. Embrace the power of UPI and experience the future of digital payments today.

If you’re interested in making money and not just spending it through UPI, we highly recommend you create a Free Demat Account now and start with your Investing Journey.