OYO is a technology-driven hospitality company that provides affordable and comfortable accommodations to travelers worldwide. Founded in 2013 by Ritesh Agarwal, the company has grown rapidly to become one of the largest hotel chains in the world.

OYO operates in over 80 countries and has more than 43,000 hotels under its brand.

Recently, the company announced plans to go public through an Initial Public Offering (IPO) to raise funds for its expansion plans.

The OYO IPO is expected to be one of the largest public offerings in India’s history and will provide investors with an opportunity to invest in a rapidly growing company with a disruptive business model.

Discussion of OYO’s Growth and Expansion Strategies

OYO’s growth and expansion have been fueled by a number of strategies, including aggressive marketing, strategic partnerships, and a focus on technology.

The company has used targeted advertising campaigns to raise awareness of its brand and has formed partnerships with travel agents and other companies to expand its reach.

OYO has also invested heavily in technology, developing its own booking platform and mobile app, as well as using data analytics to improve the guest experience.

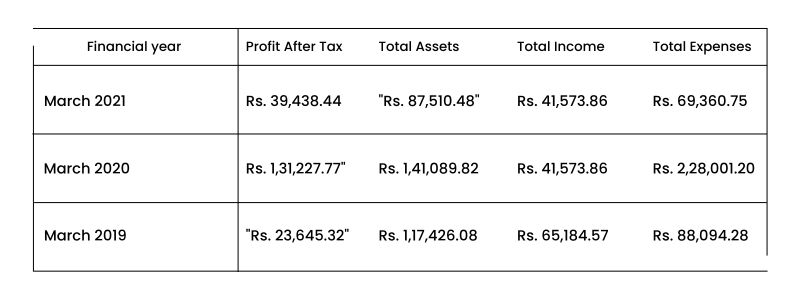

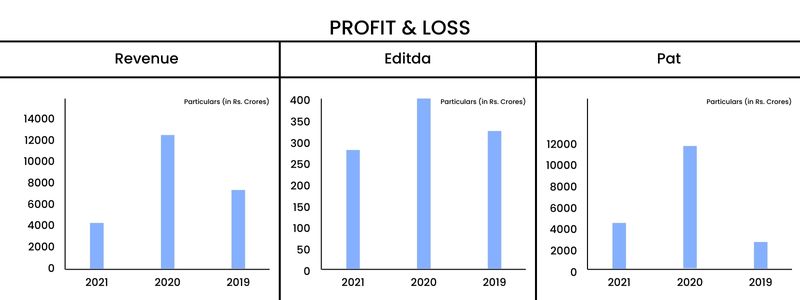

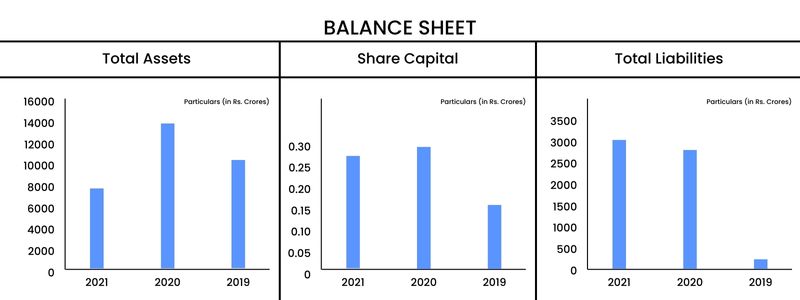

OYO IPO Financials

OYO IPO Valuation

OYO IPO Update

Examination of OYO’s Current Status in the Hotel Industry

OYO is now one of the largest hotel chains in the world, operating in over 80 countries and with more than 43,000 hotels under its brand.

The company has disrupted the traditional hotel industry with its unique business model, which focuses on offering affordable and comfortable accommodations to budget-conscious travelers.

However, OYO has also faced criticism for its rapid expansion and sometimes aggressive business practices. The company has faced challenges in some markets, including China, where it has struggled to gain a foothold.

Despite these challenges, OYO remains a major player in the hotel industry, and its upcoming IPO is a sign of its continued growth and potential for the future.

Explanation of Why OYO is Going Public

Oyo’s upcoming Initial Public Offering (IPO) is aimed at raising funds for the company’s expansion plans. The company has set ambitious targets for growth, and going public is a way to raise the capital needed to achieve those targets.

By offering shares to the public, OYO will have access to a new source of funding, which can be used to invest in technology, expand into new markets, and acquire other companies.

Going public will also increase the company’s visibility and credibility, making it easier to attract new customers and partners.

Discussion of the Potential Benefits of Going Public

Going public can bring many benefits to a company like OYO. In addition to raising funds, going public can increase the company’s profile and credibility, which can help to attract new customers and partners.

It can also provide liquidity for shareholders, which can be important for attracting and retaining talent.

Examination of the Potential Risks and Challenges Of Going Public

Going public is not without risks and challenges. OYO will be subject to greater scrutiny from investors, analysts, and regulators, which can be time-consuming and expensive.

The company will also have to balance the demands of public shareholders with the long-term goals of the company, which can be challenging.

Going public can also expose the company to market volatility and fluctuations in the stock price, which can impact shareholder value. Finally, there is a risk that going public could distract the company from its core business and growth plans.

Explanation of How to Apply for the OYO IPO

To apply for the Oyo IPO, investors will need to open a demat account with a registered depository participant (DP) and obtain a unique client ID.

They can then apply for the IPO through their broker, who will facilitate the application process. Investors can apply for the IPO either online or offline, depending on their preference.

Online applications can be made through the website of the stock exchange where the IPO is listed, while offline applications can be made through a physical application form, which can be obtained from the broker.

Discussion of the Minimum Investment Amount and Lot Size

The minimum investment amount and lot size for the OYO IPO will be determined by the company and the lead managers of the IPO.

Typically, the minimum investment amount for an IPO is set at a relatively low level to encourage retail investors to participate.

The lot size, or the minimum number of shares that can be purchased, is also determined by the company and can vary depending on the price of the shares and the demand for the IPO.

Examination of the Allotment Process

The allotment process for the OYO IPO will be managed by the lead managers of the IPO.

After the IPO has closed, the lead managers will review the applications and allocate shares based on a number of factors, including the size of the application, the price of the shares, and the demand for the IPO.

The allotment process is typically completed within a few weeks of the IPO closing, and investors will be notified of their allotment status by their broker or through their demat account.