The Zomato IPO generates a lot of interest because of the company’s strong market position and potential for growth. As one of the leading food delivery companies in India, Zomato has a loyal customer base and a recognizable brand.

Going public will enable the company to raise funds and invest in new technology and services, which could help it gain a larger market share in the rapidly growing food delivery industry. Additionally, the Zomato IPO is a sign of the booming tech industry in India, which has been attracting increasing attention from investors in recent years.

Another reason why people are interested in the Zomato IPO is because it is one of the few profitable unicorns in India. Despite facing competition from other food delivery platforms, Zomato has managed to turn a profit in recent years, which is a rarity for startups in India’s tech industry. This demonstrates the company’s ability to create a sustainable business model, which could make it an attractive investment option for those looking for long-term growth opportunities. Overall, the Zomato IPO can potentially be a game-changer for the food delivery industry in India and could pave the way for other tech startups to go public in the future.

About Zomato Limited

Zomato was founded in 2008 as an online restaurant discovery platform in India. Over the years, the company has expanded its services to include online food ordering and delivery, as well as table reservations and reviews.

Today, Zomato is one of the leading food delivery platforms in India, with a presence in over 500 cities and a network of over 1.5 million restaurants. Some of Zomato’s main competitors in the food delivery industry include Swiggy, Uber Eats, and Amazon Food. Despite facing tough competition, Zomato has managed to maintain its position as one of the top players in the industry, thanks to its strong brand reputation, innovative technology, and focus on customer satisfaction.

Zomato IPO Details

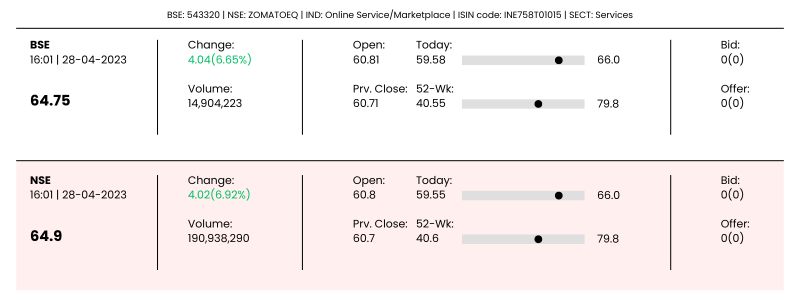

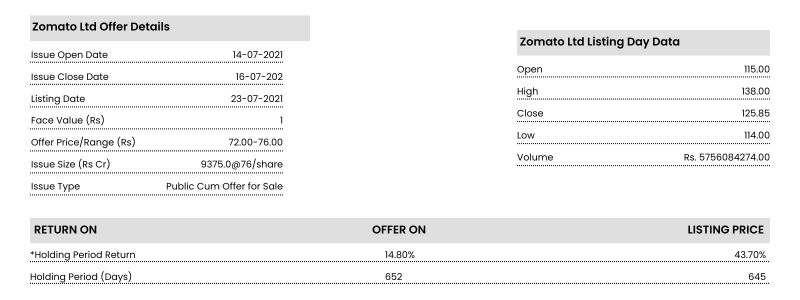

The IPO page of Zomato Ltd. captures the details on its Issue Open Date, Issue Close Date, Listing Date, Face Value, Price band, Issue Size, Issue Type, and Listing Date’s Open Price, High Price, Low Price, Close Price and Volume. It also captures the Holding Period Returns and Annual Returns.

Zomatos First Appearance

| Opening Date | July 14, 2021 |

| Closing Date | July 16, 2021 |

| Face Value | Rs. 1 per equity share |

| IPO Price Band | Rs. 72 to 76 per equity share |

| Minimum Order Quantity | 195 equity shares |

| Issue Size | Rs. 9,375 crores |

Zomato IPO Valuation

| IPO Date | Jul 14, 2021 to Jul 16, 2021 |

| Listing Date | Jul 23, 2021 |

| Face Value | ₹1 per share |

| Price | ₹72 to ₹76 per share |

| Lot Size | 195 Shares |

| Total Issue Size | [.] shares (aggregating up to ₹9,375.00 Cr) |

| Fresh Issue | [.] shares (aggregating up to ₹9,000.00 Cr) |

| Offer for Sale | [.] shares of ₹1 (aggregating up to ₹375.00 Cr) |

| Issue Type | Book Built Issue IPO |

| Listing At | BSE, NSE |

Strengths

- Large customer base

- A diverse range of services

- Strong brand reputation

- Focus on innovation and use of cutting-edge technology

Potential Risks

- Intense competition in the industry

- Regulatory challenges

- Changing consumer preferences

- Dependence on gig workers

Challenges

- Maintaining profitability in the face of price wars

- Adapting to regulatory changes and shifting market conditions

- Ensuring worker satisfaction and compliance with labour laws

- Expanding into new markets while maintaining quality and customer satisfaction.

Zomato Contact Info:

Zomato Limited

Ground Floor, 12A, 94 Meghdoot, Nehru Place

New Delhi, 110 019

Phone: +91 011 4059 2373

Email: companysecretary@zomato.com

Website: https://www.zomato.com

Zomato IPO Registrar

Link Intime India Private Ltd

Phone: +91-22-4918 6270

Email: zomato.ipo@linkintime.co.in

Website: https://linkintime.co.in

How to apply for an IPO?

– Visit the official website of the broker of your choice and register with details that include Name, Email Address, etc.

– Once registered you will receive a unique id which needs to be noted down for later use.

– Next step is opening an account in order to apply for IPOs.

If customers already own an active trading /demat account with any broker then this process can be done by logging into existing accounts directly without reregistering or creating new ones.

However, if not Customers do have the freedom to create those from within their profile itself, and funding needs separate processing as per SEBI requirements through UPI/RTGS option.

– After successful allotment of DEMAT & Trading Account numbers Initial payment has been made towards it one needs to turn on the ‘IPO’ flag accessible under the settings tab inside the demat page so that system allows the user to place bids simultaneously the time filling up all information ( bank detail, DpId).

– On the announcement, users are required to visit the Register link to present the main portfolio dashboard display EPIC WALLET credentials including PAN card Details embedded password ID once this validated acceptance correctness next phase of document verification kicks in wherein get scanned signature-based documents viz Aadhar Card voter Id Card .etc sent email Id linked first ensures secure access before proceeding to place bid