The BLS E Services IPO dates is be updated from January 30, 2024 and closes on February 1, 2024. Read the post to learn about BLS E Services IPO GMP.

The Rs 310.91 crore BLS E Services IPO is a book-built offering. The pricing range for each share is ₹129 to ₹135. 108 Shares is the minimum lot size required for an application. Retail investors are required to invest a minimum of ₹14,580. For both sNII and bNII, the minimum lot size investment is 69 lots (7,452 shares), or ₹1,006,020, and 14 lots (1,512 shares), or ₹204,120.

Start your investing journey today. Find the latest information on Upcoming IPOs.

Key Details Of BLS E Services IPO:

Bidding Dates

Jan 30-Feb 1

Price Range

₹129 to ₹135 per share

Face Value

₹10 per share

GMP

₹155

BLS E Services GMP

The BLS E-Services Limited IPO GMP Today is ₹155.

BLS E Services IPO Overview

The Rs 310.91 crore BLS E Services IPO is a book-built offering. The pricing range for each share is ₹129 to ₹135. 108 Shares is the minimum lot size required for an application. Retail investors are required to invest a minimum of ₹14,580. For both sNII and bNII, the minimum lot size investment is 69 lots (7,452 shares), or ₹1,006,020, and 14 lots (1,512 shares), or ₹204,120.

BLS E-Services The IPO price is set at ₹129-135 per share. BLS E-Services Limited’s IPO GMP today is ₹155. The minimum lot size for an application is 108 shares. Retail investors must invest a minimum of ₹14,580. The minimum lot size investment for sNII is 14 lots (1,512 shares) for ₹204,120. For bNII, it is 69 lots (7,452 shares) worth ₹1,006,020.

BLS E Services IPO Details

| IPO Date | January 30, 2024 to February 1, 2024 |

| Listing Date | [.] |

| Face Value | ₹10 per share |

| Price Band | ₹129 to ₹135 per share |

| Lot Size | 108 Shares |

| Total Issue Size | 23,030,000 shares (aggregating up to ₹310.91 Cr) |

| Fresh Issue | 23,030,000 shares (aggregating up to ₹310.91 Cr) |

| Issue Type | Book Built Issue IPO |

| Listing At | BSE, NSE |

| Share holding pre issue | 66,726,485 |

| Share holding post issue | 89,756,485 |

BLS E Services IPO Limited Financial Information

| Period Ended | 30 Sep 2023 | 31 Mar 2023 | 31 Mar 2022 | 31 Mar 2021 |

| Assets | 213.77 | 179.47 | 55.93 | 40.59 |

| Revenue | 158.05 | 246.29 | 98.40 | 65.23 |

| Profit After Tax | 14.68 | 20.33 | 5.38 | 3.15 |

| Net Worth | 120.37 | 106.94 | 15.07 | 9.68 |

| Total Borrowing | 0.00 | 0.00 | 8.76 | 11.02 |

| Amount in ₹ Crore | ||||

BLS E Services IPO Timeline

| IPO Open Date | Tuesday, January 30, 2024 |

| IPO Close Date | Thursday, February 1, 2024 |

| Basis of Allotment | Friday, February 2, 2024 |

| Initiation of Refunds | Monday, February 5, 2024 |

| Credit of Shares to Demat | Monday, February 5, 2024 |

| Listing Date | Tuesday, February 6, 2024 |

| Cut-off time for UPI mandate confirmation | 5 PM on February 1, 2024 |

BLS E Services IPO Lot Size

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Retail (Min) | 1 | 108 | ₹14,580 |

| Retail (Max) | 13 | 1404 | ₹189,540 |

| S-HNI (Min) | 14 | 1,512 | ₹204,120 |

| S-HNI (Max) | 68 | 7,344 | ₹991,440 |

| B-HNI (Min) | 69 | 7,452 | ₹1,006,020 |

| Lot Size Calculator | |||

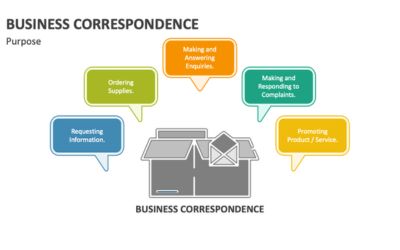

Company Profile

BLS-E Services Limited, launched in April 2016, is a digital service firm that offers Business Correspondence services to central Indian banks, Assisted E-Services, and E-Governance Services at the grassroots level in India. The company’s service offerings fall into three areas. (i) Business Correspondent Services, (ii) Assisted E-Services; and (iii) E-Governmental Services. The organisation, a subsidiary of BLS International Services Limited, provides visa, passport, consular, and other citizenship services to state and provincial governments

via a technologically advanced platform across Asia, Africa, Europe, South America, North America, and the Middle East. In this industry, it is the only publicly listed company in India. The merchant network, which serves underserved and unserved communities in difficult-to-reach areas, grew to 92,427 by March 31, 2023. Fiscal Years 2021, 2022, and 2023 saw revenue from operations of ₹6,448.72 lakhs, ₹9,669.82 lakhs, and ₹24,306.07 lakhs, in that order. The firm has 3,071 employees as of June 30, 2023, of whom 2,413 were contract workers.

Registrar Info

| Name | Kfin Technologies Limited |

| Phone number | 04067162222, 04079611000 |

| Email ID | [email protected] |

| Website | kosmic.kfintech.com |

Contact Details

| Name | BLS E-Services Limited |

| Phone number | +91-11- 45795002 |

| Email ID | [email protected] |

| Website | blseservices.com |

IPO Strengths

- Experienced promoters and a competent management team.

- Well-established relationships with a loyal customer base.

- Access to markets worldwide, enabling global reach.

IPO Weakness

- Heavy reliance on customers based in the United States.

- Need to adhere to multiple laws and regulations in these countries to ensure compliance.

- Competition from other players in the market.

BLS E Services IPO FAQs

When BLS E-Services IPO will open?

The BLS E-Services IPO opens on January 30, 2024 and closes on February 1, 2024.

What is the lot size of BLS E-Services IPO?

BLS E-Services IPO lot size is 108 Shares, and the minimum amount required is ₹14,580.

When is BLS E-Services IPO allotment?

The finalization of Basis of Allotment for BLS E-Services IPO will be done on Friday, February 2, 2024, and the allotted shares will be credited to your demat account by Monday, February 5, 2024.

When is BLS E-Services IPO listing date?

The BLS E-Services IPO listing date is not yet announced. The tentative date of BLS E-Services IPO listing is Tuesday, February 6, 2024.

Leave a Reply