India is in the process of transformation in its energy sector, and green hydrogen is at the heart of this transformation. The Indian government has taken a firm step toward the long-term development of a healthy green hydrogen economy with the release of the National Green Hydrogen Mission. To the traders and investors, this is a promising opportunity that is bolstered by policy support, demand around the world, and long-term cost benefits.

National Mission Fueling the Green Hydrogen Push

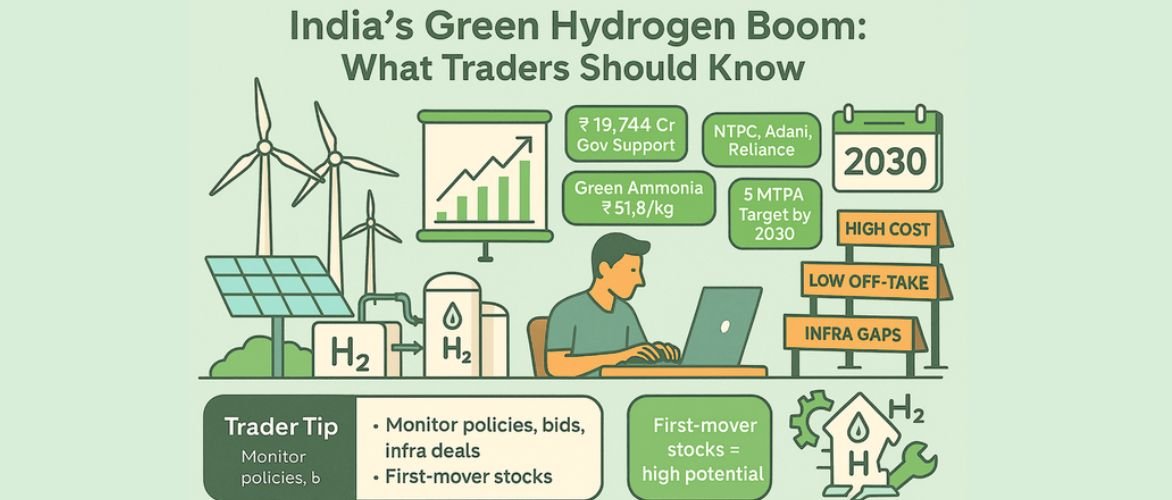

In 2023, the National Green Hydrogen Mission was announced, which has the objective of being a world leader in green hydrogen production, utilisation, and export. The mission establishes an output goal of 5 million metric tonnes (MMT) of green hydrogen every year by 2030, with about 19,744 crore rupees through government investment. This financing will enable the production of electrolysers, their large-scale production, research, and development, and pilot projects in several sectors.

The government is also expected to establish so-called Green Hydrogen Hubs – clusters that will combine production, storage, and consumption capabilities. These hubs will help in the formalisation of the supply chains and both national and international investment.

Declining Costs and Market Competitiveness.

The declining quick price of green hydrogen would be one of the most substantial shifts for the traders. The price of green ammonia, which will be a primary derivative, has fallen to about 52/kg in competitive tenders run through the SIGHT (Strategic Interventions for Green Hydrogen Transition) program. The indicator suggests that green hydrogen possesses great potential in fighting against grey hydrogen still prevalently applied in industries.

Cost reductions are anticipated in the next 10 years to below 1.50/kg green hydrogen by 2030 through economies of scale, domestic manufacture of electrolysers, and declining renewable energy prices, making green hydrogen commercially viable to power bulk industry.

Industrial and Export Demand Driving Growth.

Green hydrogen is likely to contribute significantly to decarbonising India’s hard-to-abate sectors, including oil refining, fertilisers, steel production, and heavy mobility. The shift of these industries presents the challenge of high demand for hydrogen, which presents traders with an opportunity to interact with the upstream supply and downstream purposes.

On the international stage, states such as Germany, Japan, and EU members are also on the hunt to find long-term green hydrogen importers. The geographic and economic advantages enable India to emerge as a strong contender to provide almost 10% of the world’s demand. Projects including ammonia plants in Andhra Pradesh, Gujarat, and export-oriented projects are already on the go.

Opportunities for Traders in the Emerging Ecosystem.

Green hydrogen can provide several entry points to the energy traders. These assets would emerge as easier to trade on international markets as India works toward developing traceability and certification mechanisms that can be used to certify the origin of the green hydrogen.

Key trading opportunities include:

- Long-term offtake agreements with green hydrogen producers;

- Participation in green ammonia and hydrogen tender auctions;

- Carbon credit-linked trades and renewable energy certificates;

- Export-linked derivatives and global fuel contracts.

The results of auctions, policy changes, and collaborations between corporations are also factors that traders should monitor closely in this sphere. Other green hydrogen initiatives are being established by companies such as Reliance, NTPC, and Indian Oil, which will need well-organised trade and logistics support.

Conclusion

The green hydrogen boom in India is much more than an energy tale; it is also a trading opportunity and perhaps a startup future. With scale and falling costs, first-mover advantages might favour traders who take early steps to participate in infrastructure. Heavy policy backing and increasing industrial demand are making this a market that will remain a long-term growth channel, at which one should be keen to monitor its progress.

To know more, check out IPOupcoming.com

Frequently Asked Questions (FAQs)

How is green hydrogen becoming more cost-competitive in India?

Green hydrogen costs are rapidly declining due to government subsidies, the SIGHT program, falling renewable energy prices, and domestic production of electrolysers. By 2030, green hydrogen is projected to cost less than ₹1.50/kg, making it competitive with conventional hydrogen sources.

Which sectors in India are expected to drive demand for green hydrogen?

Key sectors include oil refining, fertilisers, steel production, and heavy transportation. These hard-to-abate industries are seeking to decarbonise and will drive demand for green hydrogen, offering traders entry points through supply chain interactions and carbon credit-linked trading mechanisms.