Stock Exchanges are marketplaces where individuals and companies buy, sell and trade shares and other securities. NSE and BSE are both Major Stock Exchanges in India.

Read Our Blog And Learn To How to Buy IPO Stock

NSE and BSE Full Form

BSE Full Form Is the Bombay Stock Exchange, and NSE Full Form Is National Stock Exchange.

BSE is the oldest and among the first-ever stock exchange market in Asia. BSE was founded in 1875.

NSE is the Largest Stock Exchange Market In INDIA. NSE was founded in 1992, and in 1993 SEBI officially recognised it as a Stock Exchange.

Difference Between NSE and BSE

| Difference | NSE | BSE |

|---|---|---|

| Bench Mark Index | NIFTY 50 | BSE SENSEX |

| Companies Listed | 5,000+ | 2,000 |

| Trading Volume | VERY HIGH | LESS THAN NSE |

| Liquidity | HIGH LIQUIDITY | COMPARATIVELY LOW |

| Official Website | www.nseindia.com | www.bseindia.com |

NSE Or BSE, Which Is Better

Both the Stock Exchanges have their pros and cons. Everything depends on your investment style and the level of risk you’re willing to take.

BSE is a better choice if you like to sit and wait and let your investment grow passively.

At the same time, NSE is for people who are all in the share market, want to take risks, and are heavily informed about current market trends.

BSE Or NSE, Which Is Better For Beginners

The simple answer is BSE is better for beginners; You can invest your money in big accounts and let your investment grow on the side.

BSE Sensex has always shown long-term positive returns.

Why Is There A Price Difference Between NSE And BSE

The Price Difference between NSE and BSE is negligible and minor; ultimately, the stocks are from the same company,

and the company itself fixes the price band.

NSE and BSE are two different Stock Exchanges, like two vegetable sellers selling the same product.

The price might be different, but only by a little.

Can I buy In BSE And Sell In NSE?

Yes, you can buy in BSE and Sell it on NSE on another exchange the next Day.

The same stock cant be bought and sold on the same Day.

Can I Make a Profit By Buying In BSE and Selling On NSE?

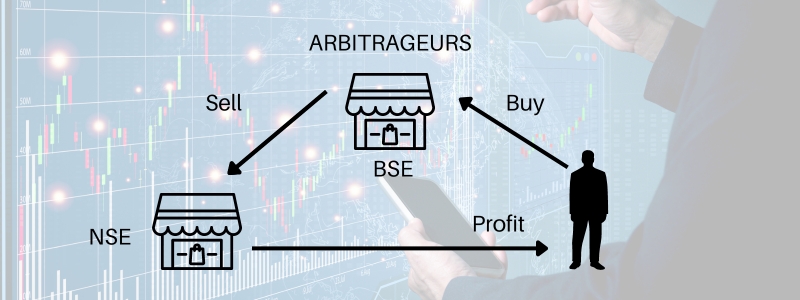

➢ You can buy the same stock cheaper on BSE and sell it on NSE for a profit,

➢ But let me tell you why this idea won’t work in the long run.

➢ Now let’s say the price of a particular stock on BSE is ₹8, and on NSE, it’s selling at ₹10.

➢ Now, with some research, you’ll be smart enough to know the price difference on both the exchanges and you could buy the stocks on bse and sell it on nse for a ₹2 profit.

➢ If you’ve figured out this loophole, other traders might have too.

➢ The current situation would be many people buying a large number of that stock on BSE for ₹8 and selling it on NSE for ₹10.

➢ The Demand on BSE for that stock increases, and the Supply on NSE increases.

➢ Huge Demand On BSE Will Cause The Price To Hike

➢ Huge Supply On NSE Will Cause The Price To Fall

➢ Hence, the profit will lessen each time, and eventually, there will be no scope for profit.

This Process of Buying from one Platform and Selling on another is called ARBITRAGE, and the people involved are called ARBITRAGEURS.

What Is Better, NSE Or BSE?

There is no clear winner both the exchange marketplaces have been supporting the Indian financial structure for a long time.

BSE offers long-term returns. NSE provides a broader selection of companies and diversity to your profile.

Most of the companies are listed both on BSE and NSE. Choose a platform that’ll support your needs and requirements and matches your level of risk-taking.

Ultimately, you can consult a financial advisor before making an investment decision.

For more Investing Opportunities, Check Out Our UPDATED LIST OF UPCOMING IPO 2023